Fillable Form W9 (2021)

Request for Taxpayer Identification Number and Certification's one of the most commonly used IRS forms. If you've ever been an employee of a company, you've probably completed a Form W-9.

Fill and sign W9 (2021) online and download in PDF.

Fillable Form W9

Request for Taxpayer Identification Number and Certification's one of the most commonly used IRS forms. If you've ever been an employee of a company, you've probably completed a Form W-9. This form is used to provide documentation and your identification number to the person or organization that pays you.

Form W-9 is essential for businesses as it helps them to report payments made to you during a tax year. Any income paid or received, be it from employment, freelance work, or investments, should be reported to the IRS using this form. The same applies to secured property after all relevant transactions have been completed, payments made to other parties, and so on. Therefore, having your Form W-9 at the ready enables companies to accurately and promptly report income paid on their end, ensuring all parties remain compliant with IRS regulations.

What is Form W-9?

Form W-9, Request for Taxpayer Identification Number and Certification, is a form by the Internal Revenue Service (IRS), the federal tax agency of the United States. Companies that hire self-employed workers use it for tax-filing purposes, such as to report income and payments made to the worker.

The IRS introduced Form W-9 in 1983 as an updated version of Form W-8, Certificate of Foreign Status. This form is used to gather the taxpayer's identification number and other details for tax purposes. It is also used by businesses that need to report certain types of income paid to their clients, such as interest, dividends, or real estate transactions.

Entities and individuals who are required to file an information return must obtain their correct Taxpayer Identification Number (TIN), Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), Adoption Taxpayer Identification Number (ATIN), or Employer Identification Number (EIN) to report amounts paid to hired self-employed professionals. When an entity or a business sends Form W-9 to a freelancer, independent contractor, or consultant, the recipient has to provide his or her personal and financial information, as required in the form.

What is a Taxpayer Identification Number?

A Taxpayer Identification Number (TIN) is a unique identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It's issued either by the Social Security Administration (SSA) or by the IRS itself. A TIN may be assigned to a business, individual or other entity. The main purpose of a TIN is to identify taxpayers and track their financial transactions. The number helps ensure that all taxpayers, whether individuals or businesses, fulfill their tax obligations as per U.S tax laws.

How is Form W-9 used?

.jpg)

Form W-9 is not a form that gets sent to the IRS but rather is used by the entity or person who pays the self-employed worker or contractor for services. The details provided in the form help the payers to prepare Form 1099-MISC, a variant of Form 1099, which reports miscellaneous types of received income. This could include fees, commissions, rents, or other forms of income paid that do not fall under other tax forms.

Form W-9 is essentially a certification provided by the payee to the payer that the correct Taxpayer Identification Number (TIN) has been provided and that the payee is not subject to backup withholding due to past issues with the IRS.

It's also worth noting that Form W-9 is purely for domestic U.S. matters. For foreign individuals or entities, Form W-8BEN is used instead. Key details needed in Form W-9 include the freelancer's or contractor's full name, business name (if different from the personal name), federal tax classification, exemptions, address, and Taxpayer Identification Number.

Form W-9 continues to play a critical role in the U.S. tax system, particularly for individuals and entities that hire independent contractors or self-employed individuals. The form collects vital information, including the taxpayer's identification number, which is essential to the payer. The stored information is used for tax compliance and preparation of Form 1099-MISC. It's important to understand that Form W-9 should be carefully completed and stored as it verifies that the correct taxpayer identification number is being used, ensuring accurate reporting to the IRS.

Is Form W-9 important in other contexts?

Indeed, Form W-9 is not limited to just business relationships. It can also be relevant in various other financial scenarios. For instance, it may be required when conducting certain real estate transactions. Additionally, if you are paying mortgage interest or student loan interest, you may need to fill out a W-9. The same applies to situations of debt cancellation or when earning interest from a bank. In all these scenarios, Form W-9 serves as an affirmation that the taxpayer identification number provided is correct and that the individual or entity is compliant with U.S. tax laws.

Therefore, whether you are a freelancer, a student, a property owner, or a debtor, understanding Form W-9 and its uses is vital. Filling it out correctly assures that you are in compliance with IRS guidelines, which can potentially save you from future tax-related problems. Always keep in mind that if you are unsure whether you need to fill out this form, it's advisable to check with the IRS or a tax professional.

If you are a self-employed professional, you will use Form W-9 when paying your self-employed taxes and filing your returns. You must keep a copy of the completed form for your records and provide it to any entity or individual that requests it, which will often happen during real estate transactions, mortgage interest reasons, or for general tax reporting purposes, among others. It's also important to update the information on file in case of any changes, such as a name change or a new Taxpayer Identification Number.

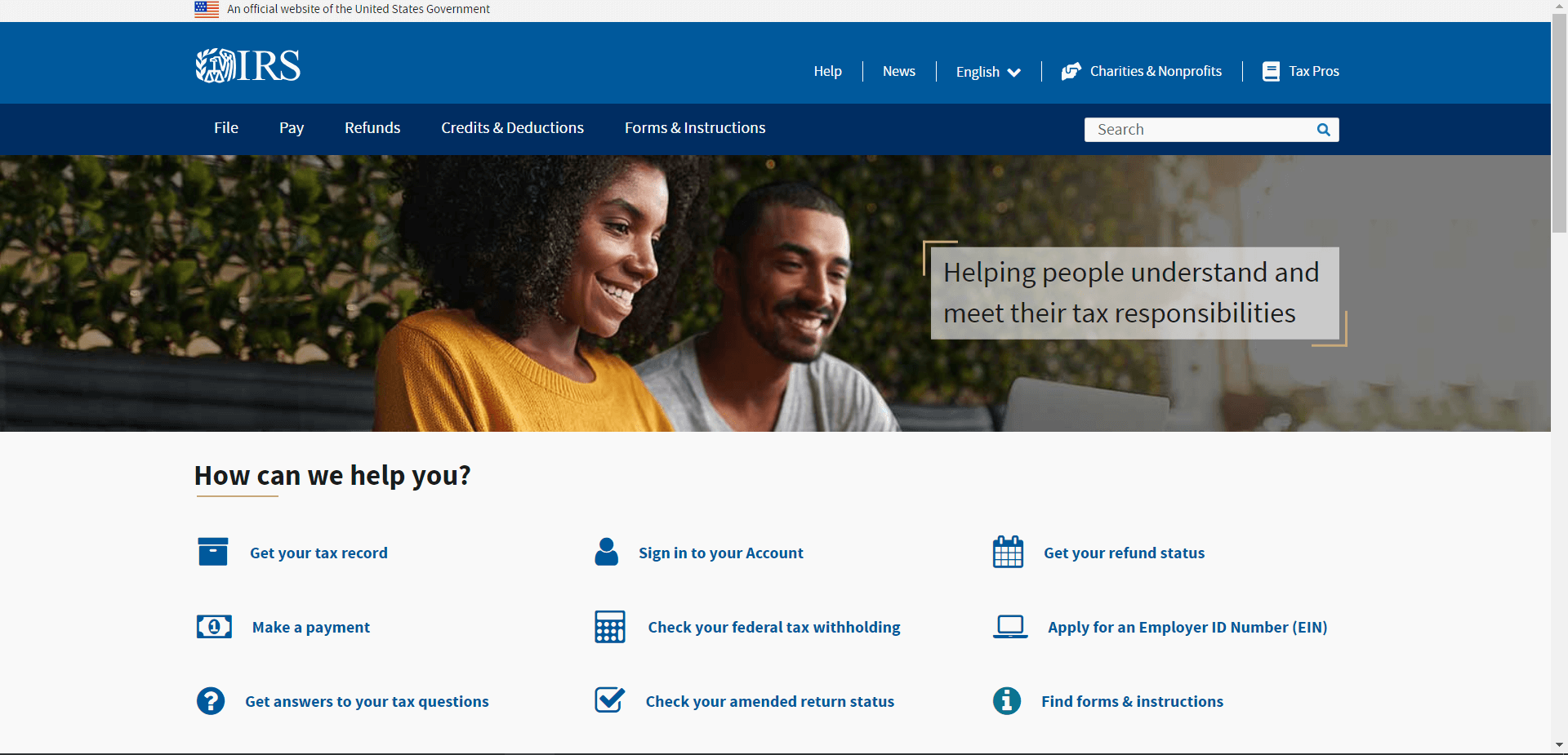

Where to get Form W-9?

You may download and print a fillable W9 form from the official IRS website that you can fill out manually. For your convenience, you can electronically fill out Form W-9 using a PDF Form filler application, such as PDFRun.

Alternatively, you can request a physical copy of the form by calling the IRS at 1-800-TAX-FORM (1-800-829-3676). Additionally, many tax preparation services provide assistance with completing Form W-9. Remember, it's critical to use the most updated version of Form W-9 for accurate reporting and compliance.

How to fill out Form W-9?

.jpg)

The W-9 Form is a single-page form that consists of three sections. Answer it accurately and correctly to avoid any problem with the IRS.

To accurately fill out a W9 form, you may need to refer to the following documents:

- Social Security Card: You'll need this to provide your Social Security Number (SSN), or if you're a business, your Employer Identification Number (EIN).

- Personal Identification: This could be a driver's license or passport. This document won't be submitted with the form, but it's good to have it handy to ensure your name is spelled correctly.

- Business License: If you're a business owner, your business license may contain information that's required on the form.

- Prior Year's Tax Return: This document can be helpful if you're unsure about your federal tax classification or exemption codes.

- Records of Your Business Entity: If you own a business, you'll need to have documentation about your entity type (e.g., LLC, partnership, etc.).

Remember, it's important to have these documents on hand to ensure the accurate completion of your W-9 form. Improper filing can lead to complications and potential issues with the IRS.

Item 1 — Name

Enter your full legal name. It should match the name on your individual tax return.

Item 2 — Business Name

Enter your business name, trade name, doing-business-as (DBA) name, or a disregarded entity name, if you have any; otherwise, you can leave this portion blank.

Item 3 — Federal Tax Classification

May the appropriate box to determine your tax status according to the IRS classification. You can select:

- Individual/sole proprietor or single-member LLC

- C Corporation

- S Corporation

- Partnership

- Trust/estate

- Limited liability company — If this option, enter the tax classification in the appropriate box. You may enter:

-

- C — For C Corporation

- S — For S Corporation

- P — For Partnership

- Other — Specify your tax status.

Item 4 — Exemptions

Enter a number or a letter code that explains your exemption. Only use this section if you are exempt from backup withholding or Foreign Account Tax Compliance Act (FATCA) reporting, or both.

Exemption from backup withholding codes:

- 1 — An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2)

- 2 — The United States or any of its agencies or instrumentalities

- 3 — A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalities

- 4 — A foreign government or any of its political subdivisions, agencies, or instrumentalities

- 5 — A corporation

- 6 — A dealer in securities or commodities required to register in the United States, the District of Columbia, or a U.S. commonwealth or possession

- 7 — A futures commission merchant registered with the Commodity Futures Trading Commission

- 8 — A real estate investment trust

- 9 — An entity registered at all times during the tax year under the Investment Company Act of 1940

- 10 — A common trust fund operated by a bank under section 584(a)

- 11 — A financial institution

- 12 — A middleman known in the investment community as a nominee or custodian

- 13 — A trust exempt from tax under section 664 or described in section 4947

Exemption from FATCA codes:

- A — An organization exempt from tax under section 501(a) or any individual retirement plan as defined in section 7701(a)(37)

- B — The United States or any of its agencies or instrumentalities

- C — A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalities

- D — A corporation the stock of which is regularly traded on one or more established securities markets, as described in Regulations section 1.1472-1(c)(1)(i)

- E — A corporation that is a member of the same expanded affiliated group as a corporation described in Regulations section 1.1472-1(c)(1)(i)

- F — A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that are registered as such under the laws of the United States or any state

- G — A real estate investment trust

- H — A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940

- I — A common trust fund as defined in section 584(a)

- J — A bank as defined in section 581

- K — A broker

- L — A trust exempt from tax under section 664 or described in section 4947(a)(1)

- M — A tax-exempt trust under a section 403(b) plan or section 457(g) plan

Item 5 and 6 — Address

Enter your address, including your house number, street , and apartment or suite number, city, state, and ZIP code.

Requester’s name and address

This item is optional. Enter the requester’s full legal name and residence address.

Item 7 — Account Numbers

This item is optional. Enter any account numbers the business or individual who sent Form W-9 may find useful.

Part I — Taxpayer Identification Number (TIN)

Enter your nine-digit SSN if you are filling out Form W9 as an individual or single-member LLC.

Enter your EIN if you are filing for a corporation or partnership.

Enter your SSN and EIN if you are filing as a sole proprietor.

Part II — Certification

Signature of U.S. person

Affix your signature.

Date

Enter the date you signed the form.

Where to submit Form W-9?

When you receive the W-9 Form from a business or an individual who hired you as an independent contractor, do not submit Form W-9 to the IRS after filling it out; return it to the sender first, then keep a copy for your record. If you are filling out Form W9 for a joint account, the form should include information about all the joint owners and be signed by each owner listed on the account.

You have to submit Form W-9 only if requested by the IRS or any other federal agency.

Frequently Asked Questions

Q1: What is a W-9 Employee?

A1: A W-9 employee is not a typical employee. It refers to individuals who are independent contractors, freelancers, self-employed individuals, or sole proprietors.

Q2: Does everyone I work with need my W-9 Form?

A2: Not necessarily. A business or individual may request your W-9 if they want to file an information return with the IRS that relates to you, such as Form 1099-MISC for miscellaneous income. Otherwise, they do not need your W-9.

Q3: Do I have to submit a new W-9 Form if my information changes?

A3: Yes. If any of the information on your W-9 Form changes, you must provide an updated form to the requester within 30 days of the change. This includes changes in your name, business entity (such as from a sole proprietor to a corporation), or TIN.

Q4: Can I submit my W-9 form online?

A4: Yes. You can fill out and sign Form W-9 electronically using secure e-signature technology. However, you must still provide the requester with a paper copy of the completed form for their records.

Q5: What happens if I don't file a W-9 Form?

A5: If you are requested to submit Form W-9 and fail to do so, the requester may be required to withhold 24% of any payments made to you for tax purposes. It is in your best interest to provide the requested information on time.

Q6: What if I provide the wrong Taxpayer Identification Number?

A6: If you provide the wrong Taxpayer Identification Number on your W-9 Form, you may be subject to backup withholding of taxes at a rate of 24% on any payments made to you. Additionally, providing incorrect information may result in penalties and fines from the IRS, such as a $50 penalty for each incorrect Taxpayer Identification Number.

Q7: What is Backup Withholding?

Backup withholding is a tax system that requires the payer to withhold taxes from certain types of payments. This situation usually arises when the payee fails to provide a correct taxpayer identification number (TIN) or if the IRS notifies the payer that the payee is subject to backup withholding due to prior underreporting of income.

The current rate for backup withholding is 24%. The withheld amount is then forwarded directly to the IRS. Backup withholding can apply to most kinds of payments that are reported on IRS Form 1099, including interest, dividends, non-employee compensation, and certain rents and royalties.

Q8: Can I use Form W-9 for any other purposes?

A8: No. The primary purpose of Form W-9 is to provide your correct Taxpayer Identification Number and certification that you are not subject to backup withholding. It should not be used for any other purposes, such as applying for loans or credit cards. However, certain government agencies may request a completed W9 form before making payments to individuals or businesses.

Q9: How long should I keep a copy of my submitted Form W-9?

A9: It is recommended to keep a copy of your completed and submitted Form W-9 for at least four years, as the IRS may request proof of your income or withholding taxes in the future. Overall, it is crucial to accurately and promptly submit your Form W-9 when requested to avoid potential penalties and ensure proper tax compliance. So whether you are an independent contractor, freelancer, or self-employed individual, be sure to have a good understanding of Form W-9 and its purpose. For any further questions or concerns about Form W-9, consult with a tax professional for accurate and specific advice.

Q10: Does Form W-9 need to be filed alongside an income tax return, or any other tax form?

A10: No, Form W-9 doesn't need to be filed alongside an income tax return, or any other tax form. It is not a tax return form, but a request for your Taxpayer Identification Number, sent by an entity that will pay you income during the tax period The entity uses the information on the W-9 to prepare other tax documents, such as IRS Form 1099-MISC, which is then sent to you and the IRS. Form W-9 should be completed and returned to the requester, not to the IRS.

Q11: How is Form W-9 used in real estate transactions and mortgage interest?

A11: Form W-9 is commonly used in real estate transactions to confirm the TIN of sellers and borrowers. For instance, when purchasing a property, the buyer may request a completed W-9 from the seller to report the transaction to the Internal Revenue Service (IRS) before the transaction can be completed and the secured property transferred to the relevant person(s).

Moreover, financial institutions or lenders may request a W-9 from borrowers during the mortgage application process to confirm their TIN and report mortgage interest to the IRS. Consequently, if you pay mortgage interest, you may receive IRS Form 1098 (Mortgage Interest Statement) from your mortgage lender, who should have your correct TIN from the W9 form you completed at the time of loan initiation.

Q12: Why is having a TIN important?

A12: Having a TIN is crucial because it's a unique identifier used by the IRS for tax purposes. The IRS uses it to track your tax obligations and ensure you meet your responsibilities. Without a TIN, processing tax documents, claiming tax benefits or deductions, and reporting income or loss would be challenging. For businesses, a TIN is necessary to issue tax documents to employees or independent contractors. It's also needed for opening bank accounts, obtaining licenses, and registering for a business entity. Essentially, a TIN is an essential tool for managing your tax matters efficiently and effectively.

Q13: How does a real estate transaction affect my tax obligations?

A13: Real estate transactions can significantly impact your tax obligations. For instance, if you sell a property, the profits from the sale may be subject to capital gains tax. However, there are exemptions and deductions available, such as the home sale exclusion for primary residences. On the other hand, if you purchase a property, you may be able to deduct certain expenses like mortgage interest, property taxes, and certain closing costs when you file your taxes. It's important to consult with a tax professional to understand the specific tax implications of any real estate transactions.

Q14: How and where should I store a tax document like Form W-9?

A14: Proper storage of tax documents is vital for future reference, and in case of an audit. Ideally, tax documents should be stored in a secure and organized manner for easy retrieval. Physical copies should be kept in a fireproof and waterproof safe or locked file cabinet. For digital copies, ensure they are stored on a secure computer or cloud-based system that is password protected. It's advisable to keep copies of tax returns and all related documents for at least three years, as per the IRS's period of limitations. However, certain documents like those related to property or investments should be kept longer. Always consult with a tax professional if you're unsure about how long to retain specific tax documents.

Keywords: w9 online w9 forms w9 irs form w-9 w-9 2021 printable w9 form for 2021 w9 form w 9 form 2021 2021 w 9 w 9 2021 form blank w 9 form 2021 w 9 forms