As another tax season approaches, and you might be asking yourself, “How to do my taxes?” Worry not, because the annual ritual of filing taxes looms large for millions of Americans.

If you’re a newcomer to the process, understanding how to navigate the complexities of the tax code can feel daunting. Fortunately, you don’t have to be a tax expert to file your taxes with confidence in 2024.

In this guide, we’ll walk you through the essential steps of filing taxes in the United States, breaking down the process into manageable and easy-to-understand segments. From getting organized and choosing the right filing method to understanding deductions and credits, we’ll cover everything you need to know to successfully complete your tax return.

Taking charge of your taxes offers more than just financial benefits – it’s about empowerment. When you understand the intricacies of tax filing, you’re not just filling out forms; you’re taking control of your financial situation.

From unlocking potential savings to confidently managing your finances, filing your own taxes signifies a journey toward financial independence and expertise. Let’s embark on this endeavor together, unraveling the intricacies of taxes while embracing the principles of fiscal responsibility and empowerment.

Why Learn How to Do My Taxes?

Before we start our in-depth discussion on tax filing, talking about tax deductions and deadlines, let’s answer the question (or questions) in your mind, “Why should I learn how to do my taxes by myself? Wouldn’t it be simpler to hire a professional? Or even easier, just skip filing taxes altogether?”

Well, here’s why. Filing your own taxes offers a plethora of advantages that extend beyond just financial savings.

- Financial Empowerment

Firstly, it provides a deep sense of empowerment and control over your financial affairs. By taking charge of your taxes, you’re actively engaging with your financial situation, gaining a comprehensive understanding of your income, expenses, and potential tax liabilities. This hands-on approach fosters a greater connection with your finances, leading to informed decision-making and overall financial well-being.

- Financial Literacy

Moreover, the process of preparing your own taxes can be a valuable learning experience. As you navigate through tax forms, calculations, and documentation, you inevitably develop a deeper understanding of the tax system and how it applies to your specific circumstances. This increased knowledge not only benefits you in the short term but also equips you with essential financial literacy skills that are invaluable throughout your lifetime.

- Cost Savings

Another significant benefit of filing your own taxes is the potential for cost savings. While hiring a tax professional may be necessary for complex tax situations or individuals who prefer assistance, for many taxpayers, self-filing can result in substantial savings on tax preparation fees. This frees up financial resources that can be allocated towards other important priorities or saved for future endeavors.

- Flexibility and Convenience

Furthermore, self-filing allows for greater flexibility and convenience. You’re not constrained by the availability of a tax professional or bound by appointments. Instead, you have the freedom to work on your taxes at your own pace and on your own schedule. This flexibility can be particularly beneficial for individuals with busy lifestyles or unpredictable schedules, allowing them to manage their taxes efficiently without added stress.

- Timely Submission

Additionally, filing your own taxes enables timely submission, reducing the risk of penalties and interest charges associated with late filing. By taking control of the process, you can ensure that your taxes are filed accurately and on time, avoiding unnecessary financial setbacks and maintaining compliance with tax regulations.

- Tax Optimization

Lastly, self-filing can lead to the maximization of tax savings. When you’re intimately familiar with the tax code, tax deductions, and tax credits available to you, you’re better equipped to identify opportunities for tax optimization. This may result in a larger tax refund or a reduced tax liability, ultimately enhancing your financial outcomes.

In summary, the benefits of filing your own taxes extend far beyond mere cost savings. It offers empowerment, learning opportunities, flexibility, convenience, timely submission, and potential tax savings. By embracing self-filing, you not only gain control over your finances but also cultivate valuable skills and knowledge that empower you to make informed financial decisions for years to come.

Understanding Important Tax Terminologies

Understanding tax terminologies is vital as it allows you to comprehend tax laws, communicate effectively with professionals, ensure accurate tax reporting, and optimize tax planning.

Let’s discuss some of the most important tax terminologies.

1. Tax Brackets: Tax brackets are the ranges of taxable income that determine the rate at which income is taxed. The US tax system is progressive, meaning that as your income increases, you move into higher tax brackets and pay a higher percentage of your income in taxes. Tax brackets are divided into various income ranges, each corresponding to a specific tax rate.

For example, the tax bracket for 2024 looks like this:

| Federal Marginal Tax rate | Single filers | Married couples filing jointly | Married couples filing separately | Head of household |

| 10% | $11,600 or less | $23,200 or less | $11,600 or less | $16,550 or less |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 | $11,601 to $47,150 | $16,551 to $63,100 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 | $47,151 to $100,525 | $63,101 to $100,500 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,526 to $191,150 | $100,501 to $191,150 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,151 to $243,725 | $191,151 to $243,700 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,276 to $365,600 | $243,701 to $609,350 |

| 37% | $609,351 or more | $731,201 or more | $365,601 or more | $690,351 or more |

2. Federal Marginal Tax Rate: Your federal marginal tax rate is the tax rate applied to the last dollar of taxable income you earn within a tax bracket. It’s important to note that your marginal tax rate may differ from your effective tax rate, which we’ll discuss shortly. As you move into higher tax brackets, your marginal tax rate increases. For example, if you’re a single filer with taxable income of $50,000 in 2024, your marginal tax rate would be 22%, as you’re in the 22% tax bracket.

3. Federal Effective Tax Rate: Your federal effective tax rate, on the other hand, is the average rate at which your total income is taxed after accounting for all deductions, credits, and exemptions. It reflects the actual percentage of your income that you pay in federal income taxes. Your effective tax rate is typically lower than your marginal tax rate because the US tax system is progressive, and you benefit from lower tax rates on the first dollars of income.

4. Tax Deductions: Tax deductions reduce the amount of taxable income you report to the Internal Revenue Service (IRS). They represent certain expenses or contributions that are eligible for a tax break. Deductions lower your taxable income, which ultimately reduces the amount of tax you owe. Common examples are:

a. Standard Deduction: The standard deduction is a flat amount that taxpayers can deduct from their taxable income, based on their filing status. For example, in 2024, the standard deduction for single filers is $12,550, while for married couples filing jointly, it’s $25,100.

b. Mortgage Interest Deduction: Homeowners who itemize deductions can deduct the interest paid on their mortgage loans, up to certain limits. This deduction is particularly valuable for homeowners with large mortgage balances.

c. Charitable Donations: These are contributions made to qualified tax-exempt organizations, such as nonprofit organizations, religious institutions, educational institutions, and charitable foundations. These serve various charitable purposes, including supporting humanitarian causes, funding research and education, providing aid to those in need, and promoting cultural and community initiatives.

5. Tax Credits: Tax credits, on the other hand, directly reduce the amount of tax you owe, dollar for dollar. They are typically based on specific criteria, such as income level, family size, or qualifying expenses. Unlike deductions, which reduce taxable income, tax credits reduce your actual tax bill, making them particularly valuable. Common tax credits include:

a. Child Tax Credit: The Child Tax Credit provides a credit of up to $2,000 per qualifying child under the age of 17. Eligibility for the credit depends on factors such as the child’s age, relationship to the taxpayer, and income level.

b. Earned Income Tax Credit (EITC): The Earned Income Tax Credit (EITC) is a refundable tax credit designed to provide financial assistance to low-to-moderate-income working individuals and families. Unlike non-refundable tax credits, which can only reduce a taxpayer’s tax liability to zero, the EITC can result in a refund if the credit amount exceeds the taxpayer’s tax liability. This makes the EITC particularly valuable for eligible individuals and families, as it can provide additional income to help meet basic needs and improve financial stability.

c. Lifetime Learning Credit: The Lifetime Learning Credit is a tax credit available to taxpayers who incur qualified education expenses for themselves, their spouse, or their dependents while pursuing higher education. Unlike the American Opportunity Tax Credit (AOTC), which is available only for the first four years of post-secondary education, the Lifetime Learning Credit can be claimed for an unlimited number of years and can be used for undergraduate, graduate, and professional degree courses, as well as courses to acquire or improve job skills.

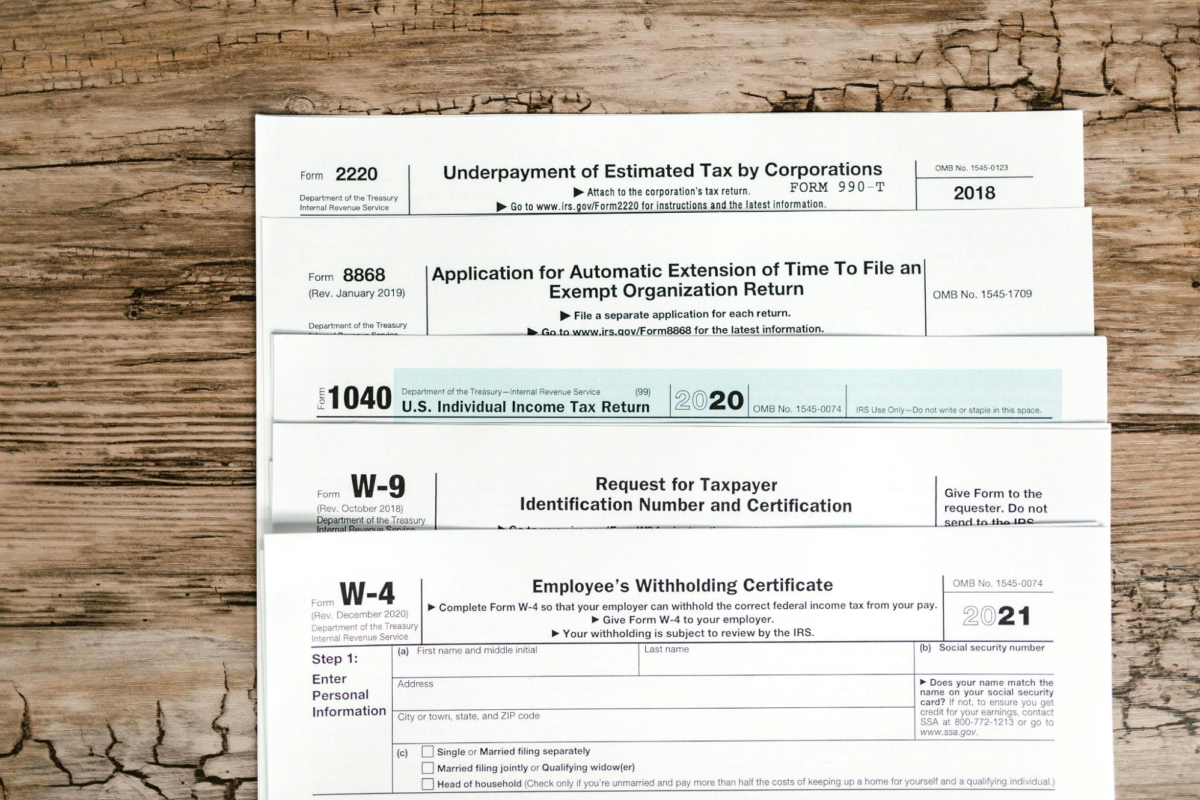

Organizing the Necessary Tax Forms

Gathering all necessary documents ensures that you have everything you need to accurately report your income, deductions, and credits to the IRS. Failing to gather essential documents can lead to errors, omissions, and potential discrepancies in your tax return, which may result in penalties or audits.

Some of the most common documents needed for tax filing include:

- Form 1040: Also known as the “US Individual Income Tax Return,” this is the standard form used by individuals to file their annual income tax returns with the IRS in the United States. It’s the most comprehensive form and is suitable for taxpayers with various income sources, deductions, and credits.

- W-2 Forms: These forms report your wages and tax withholdings from employment.

- 1099 Forms: Various 1099 forms report income from sources such as freelance work, interest, dividends, and retirement account distributions.

- Receipts for Deductible Expenses: Receipts and documentation for deductible expenses, such as mortgage interest, charitable donations, medical expenses, and business expenses, are essential for claiming deductions and minimizing your tax liability.

- Investment Statements: Statements from investment accounts, including brokerage accounts and retirement accounts, provide information on capital gains, dividends, and interest income.

- Records of Income and Expenses: Any additional sources of income, such as rental income or self-employment income, should be documented along with corresponding business expenses or deductions.

- Health Insurance Information: Documentation of health insurance coverage, including Form 1095-A, B, or C, is necessary to comply with the Affordable Care Act requirements.

- Previous Tax Returns: Having copies of your previous tax returns can provide valuable reference information and help ensure consistency in reporting.

To streamline the tax preparation process, consider the following tips for organizing your documents:

- Create a designated tax folder or digital folder where you can keep all tax-related documents throughout the year.

- Organize documents by category (e.g., income, deductions, credits) to make it easier to locate specific information when needed.

- Use labels or tabs to differentiate between different types of documents within your tax folder.

- Keep digital copies of all documents, either scanned or photographed, to ensure backup in case of loss or damage.

- Make a checklist of all required documents and check them off as you gather them to ensure nothing is overlooked.

By gathering all necessary documents and organizing them efficiently, you’ll be well-prepared to tackle the tax filing process with confidence and accuracy. This proactive approach not only simplifies the process but also helps minimize stress and potential errors along the way.

Choosing the Best Tax Filing Method

When it comes to filing your taxes, you have two main options: filing electronically (e-filing) or filing by mail. Each method has its own set of advantages and considerations, so it’s important to weigh your options carefully before making a decision.

- Filing Electronically (E-Filing):

E-filing has become increasingly popular in recent years due to its convenience and efficiency. With e-filing, taxpayers submit their tax returns electronically to the IRS using approved tax preparation software or through authorized tax professionals. Some key benefits of e-filing include:

- Faster Processing Times: E-filed returns are typically processed much faster than paper returns, resulting in quicker refunds for taxpayers.

- Reduced Chance of Errors: Tax preparation software helps minimize errors by performing calculations automatically and providing prompts for missing information. This can help ensure that your tax return is accurate and complete.

- Filing by Mail:

Filing by mail involves filling out a paper tax return (such as Form 1040) by hand and mailing it to the IRS. While less common than e-filing, some taxpayers still prefer this method for various reasons, such as personal preference or limited access to technology. Some considerations for filing by mail include:

- Longer Processing Times: Paper returns generally take longer to process than e-filed returns, so taxpayers who file by mail may experience delays in receiving their refunds.

- Greater Risk of Errors: Filling out paper forms by hand increases the risk of errors or omissions on your tax return, which could potentially lead to processing delays or IRS inquiries.

Choosing the Best Filing Method:

When deciding which filing method is best for you, consider the following factors based on your individual circumstances and preferences:

- Comfort Level with Technology: If you’re comfortable using computers and software, e-filing may be the preferred option for its convenience and efficiency. However, if you prefer working with paper forms or don’t have access to a computer, filing by mail may be more suitable.

- Complexity of Tax Situation: If you have a relatively simple tax situation with few deductions or credits, either filing method may be suitable. However, if your tax situation is more complex, you may benefit from the accuracy checks and guidance provided by tax preparation software when e-filing.

- Time Constraints: If you’re filing close to the tax deadline and need to expedite the process, e-filing may be the best option due to its faster processing times. Filing by mail may result in longer processing times and potential delays in receiving your refund.

Ultimately, the best filing method for you will depend on your individual circumstances, preferences, and priorities. Regardless of the method you choose, be sure to gather all necessary documents and information before starting the tax preparation process, and double-check your return for accuracy before submitting it to the IRS.

6 Tips for Filing Out Tax Forms

You’ve learned the jargon, gathered the forms, and chosen your preferred filing method. Now, it’s time to fill out the forms you will send to the IRS. Tax forms are fairly straightforward documents, so you simply have to provide the information asked of you. But if you run into trouble, these tips might help:

- Read Instructions Carefully

Before you start filling out any tax forms, take the time to read the instructions thoroughly. The instructions provide valuable guidance on how to complete each section of the form and may include important information about eligibility criteria, deductions, credits, and other requirements.

- Be Accurate

Accuracy is crucial when filling out tax forms. Make sure you enter all information correctly, including names, Social Security numbers, and financial data. Even minor errors or typos can lead to delays in processing your return or trigger IRS inquiries.

- Double-Check Your Entries

Take the time to review each section of your tax forms carefully before submitting them. Check for accuracy and completeness, and make sure you haven’t overlooked any deductions, credits, or other important information.

- Sign and Date Your Return

Don’t forget to sign and date your tax return before submitting it to the IRS. If you’re filing jointly with your spouse, both spouses must sign the return. Failure to sign your return could result in processing delays or rejection by the IRS.

- Keep Copies of Your Tax Forms

Make copies of your completed tax forms and any supporting documents for your records. Keep these copies in a safe place along with your other financial records for future reference.

- Seek Assistance if Needed

If you’re unsure about how to fill out certain sections of your tax forms or have questions about your tax situation, don’t hesitate to seek assistance from a tax professional or utilize IRS resources for guidance. It’s better to ask for help than to risk making mistakes on your tax return.

The Next 4 Steps in the Tax Filing Process

Once you’ve filled out your tax forms, the next steps involve submitting your tax return to the IRS and navigating the processing phase. Here’s a detailed guide to help you through the next parts of the process:

- Submit Your Tax Return

- After carefully reviewing your tax return for accuracy and completeness, it’s time to choose your filing method and submit your return to the IRS.

- If you opt for electronic filing (e-file), use IRS-approved tax preparation software or a qualified tax professional to transmit your return securely to the IRS. Follow the instructions provided by your chosen method to complete the submission process.

- Alternatively, if you prefer to file by mail, make sure to include all required forms and documentation with your tax return. Mail your return to the appropriate IRS address based on your location and the type of return you’re filing.

- Receive Confirmation (for e-filers)

- If you e-file your tax return, you’ll typically receive an electronic confirmation from the IRS once your return has been successfully transmitted. This confirmation serves as proof that your return was received and accepted by the IRS. Keep this confirmation for your records.

- Processing Your Return

- After receiving your tax return, the IRS begins the process of reviewing and verifying the information provided. The IRS checks for accuracy, calculates your tax liability or refund, and identifies any potential issues or discrepancies.

- Processing times vary depending on factors such as the complexity of your return, the time of year, and IRS workload. Generally, e-filed returns are processed more quickly than paper returns.

- Receive Your Refund or Notice

- If you’re entitled to a refund, the IRS will issue it to you once your return has been processed successfully. You can choose to have your refund deposited directly into your bank account (via direct deposit) or mailed to you as a paper check. Direct deposit is typically the fastest way to receive your refund.

- If there are any issues or discrepancies with your return, the IRS may send you a notice requesting additional information or clarification. It’s essential to respond promptly and provide the requested information to resolve any issues and ensure timely processing of your return.

- Keep Records

- After submitting your tax return, keep copies of your completed return and any supporting documents for your records. Retain these records for at least three years after the filing date, as they may be needed for future reference or in case of IRS inquiries or audits.

- If you e-filed your return, you can also keep the electronic confirmation of submission as proof that your return was filed on time and accepted by the IRS.

By following these steps, you can successfully submit your tax return to the IRS, track its processing, and ensure that any refunds or notices are handled promptly and accurately.

5 Post-Filing Considerations

After submitting your tax return to the IRS and navigating the processing phase, there are several important post-filing considerations and actions to keep in mind:

- Tracking Refund Status

Stay informed about the status of your tax refund using the IRS’s “Where’s My Refund?” tool. This online tool allows you to track the progress of your refund and provides estimated deposit dates. Check the tool periodically for updates on your refund’s processing status.

- Responding to IRS Notices

If you receive a notice or correspondence from the IRS regarding your tax return, review it carefully and take prompt action as needed. Follow the instructions provided in the notice, address any issues raised, and provide any requested information or documentation to the IRS in a timely manner.

- Amending Tax Returns

If you discover errors or omissions on your tax return after filing, you may need to amend it using Form 1040X. Common reasons for amending a return include correcting income amounts, adding or removing dependents, or claiming additional deductions or credits. Follow the instructions on Form 1040X and submit the amended return to the IRS as soon as possible.

- Payment Arrangements for Taxes Due

If you owe additional taxes that you’re unable to pay in full by the tax filing deadline, consider exploring payment arrangements with the IRS to avoid penalties and interest charges. Options may include setting up an installment agreement or requesting a temporary delay in collection until your financial situation improves.

Take proactive steps to optimize your tax situation for future tax years. Consider strategies such as maximizing contributions to retirement accounts, leveraging tax-advantaged investment opportunities, and staying informed about changes to tax laws that may impact your tax liabilities and benefits.

By addressing these post-filing considerations, you can effectively manage your tax obligations, address any issues that arise after filing, and plan for future tax years with confidence and peace of mind.

Some Tax Filing FAQs

- What should I do if I can’t pay my taxes in full by the deadline?

If you’re unable to pay your taxes in full by the deadline, you should still file your tax return on time to avoid penalties for late filing. Consider setting up an installment agreement with the IRS to pay your taxes over time, or explore other payment options available through the IRS.

- What happens if I miss the tax filing deadline?

If you miss the tax filing deadline, you may be subject to penalties and interest on any unpaid taxes. It’s essential to file your tax return as soon as possible to minimize potential penalties. If you’re due a refund, there’s generally no penalty for filing late, but you must file within three years to claim your refund.

- What are the consequences of filing taxes late?

Filing taxes late may result in penalties and interest charges on any unpaid taxes owed. The penalty for filing late is typically 5% of the unpaid tax amount per month, up to a maximum of 25% of the unpaid tax. It’s essential to file your tax return on time, even if you can’t pay the full amount owed, to avoid additional penalties.

- Can I file my taxes electronically if I’m filing for the first time?

Yes, you can file your taxes electronically (e-file) even if it’s your first time filing. Many tax preparation software programs offer step-by-step guidance for first-time filers, making the process straightforward and efficient.

- I received a tax refund last year. Will I receive one again this year?

Whether or not you receive a tax refund depends on various factors, including changes in your income, deductions, and tax credits from year to year. Additionally, if you had more taxes withheld from your paychecks than necessary, you may receive a refund, but if you owe taxes or didn’t have enough withheld, you may owe additional taxes.

- Can I deduct expenses related to working from home on my taxes?

As of 2024, employees who work from home due to COVID-19 are generally unable to deduct home office expenses on their taxes. However, self-employed individuals and independent contractors may still be eligible to deduct qualifying home office expenses. It’s advisable to consult with a tax professional for guidance on specific deductions.

- What should I do if I lost my tax documents or didn’t receive them?

If you lost your tax documents or did not receive them, you can request duplicates from the issuing party, such as your employer or financial institution. Additionally, you can access certain tax documents electronically through online accounts or contact the IRS for assistance in obtaining copies of prior-year tax transcripts. Keeping accurate records and maintaining backups of important documents can help prevent issues with lost or missing tax documents in the future.

Easing the Tax Filing Process with PDFRun

In conclusion, filing taxes can seem like a daunting task, but with the right knowledge and preparation, it doesn’t have to be overwhelming. By understanding the key concepts of tax filing, gathering the necessary documents, and utilizing available resources, individuals can navigate the tax filing process with confidence and accuracy.

Throughout this guide, we’ve covered essential topics such as understanding tax terminology, organizing documents, choosing the right filing method, completing tax forms accurately, and post-filing considerations. We’ve also addressed common questions and concerns about tax filing, providing clarity and guidance to help individuals make informed decisions.

We’ve got just one more tip for you. If you want to ease the tax filing process, particularly the gathering and filling out of forms, you could check out PDFRun! There, you can find a library of tax documents, which you can also fill out using the software, and then download either for emailing, printing, or record keeping.

As we’ve discussed, tax filing is not just a once-a-year task but an ongoing process that requires careful planning and attention to detail. By staying organized, keeping abreast of tax law changes, and seeking professional assistance when needed, taxpayers can optimize their tax situation, minimize tax liabilities, and achieve their financial goals.

Remember, the key to successful tax filing is preparation and diligence. By taking the time to educate yourself, gather necessary documents, and file your taxes accurately and on time, you can avoid potential issues, maximize tax benefits, and ensure compliance with IRS regulations.

We hope this guide has empowered you with the knowledge and tools you need to navigate the tax filing process effectively.